Sparking sustainable success

Why be Sustainable?

The best businesses engage, inform and improve outcomes not only for themselves, but also for their industry, their customers and our planet.

Being a sustainable business is a competitive advantage. It has a positive impact on society and delivers on the increasing expectations of your customers, employees, investors and supply chain.

What are your

sustainability goals?

Build Capability

- Develop resiliency and be Supply Chain Ready

Learn More

- Get there faster and stand out from your competitors

Learn More

Here to help you create a better tomorrow

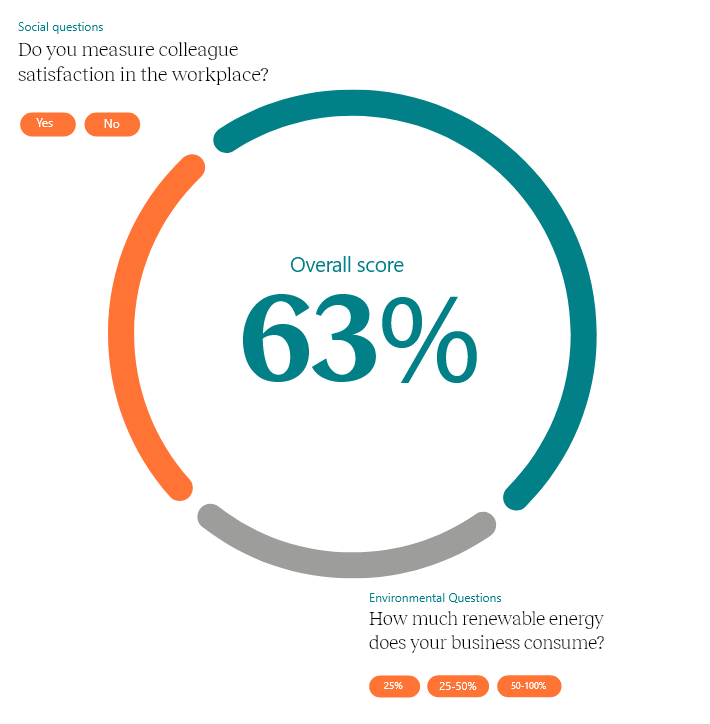

Fast, affordable ESG insights and actions

We blend innovative technology with deep ESG expertise to offer pioneering, cost-effective access to top-quality assessments, analysis and consultancy advice that gives SMEs a competitive edge.

Help to get started… and to get results

Everything we do is optimised for efficiency, impact and cost-effectiveness. But you’ll find we provide a distinctly personal touch too. From the outset to the evolution of your ESG journey,

Driving and delivering positive change

We want to help you make a difference – in your business and the wider world. We do this by tailoring our advice and supporting you to inspire others to deliver sustainable success.

Unlock your growth potential

Take full

advantage of:

ESG insights and intelligence

Business resiliency assessments

Sector-specific benchmarking

Fast, affordable, in-depth reports

Advice and actions for improvements

The expertise you need

Game-changing affordability and accountability

TDH are sustainability analysis specialists. We offer impressively speedy and affordable ESG reviews and benchmarking for start-ups, scale-ups and large companies, blended with pioneering consultancy insights, to help boost all-round performance in your business.

Inspiring sustainable business success

We’re passionate about providing easy, affordable access to high-quality ESG insights and intelligence that enables SMEs to target and achieve sustainable business success.

Quick and influential ESG credentials

Go from getting started… to getting results in a matter of weeks. Our streamlined service gives you access to quick and influential ESG credentials. So you can drive and deliver positive change across your business – and start to unlock tomorrow’s opportunities today.

Fast-tracked ESG and business resiliency insights to help you grow

• Increase your profits

• Win new customers

• Mitigate business risks

• Enhance efficiency

• Interest top talent

• Retain employees

• Attract investors

• Improve your credit score

What’s the primary driver for embedding sustainability in your business?

ESG

Are you looking to not only drive sustainable growth but also create long-lasting value for your stakeholders and the planet. Integrating ESG principles into your business strategy is key.

Business Resilience

Do you need to boost the resilience of your business? We’ll help you enhance adaptability to tackle challenges and capitalise on opportunities, fostering sustainable growth and success.

What people say

CITYDATA

Turkbankasi

Model Office

Rimes

Recognise Bank

Giift.com

The Octopus Club

Get started

today

Explore a game-changing service that gives you fast, responsive access to expert assessment and analysis, plus top consultancy insights and advice – at a very affordable price.

Collaborating

for a sustainable future

We work collaboratively with a strong network of partners, who share our vision for a sustainable and resilient future. Together, we drive ESG innovation and support businesses on their journey towards sustainability excellence.